Global Cold Chain Packaging Market: Pioneering Temperature-Controlled Logistics for a Connected World (2025–2032)

Market Overview

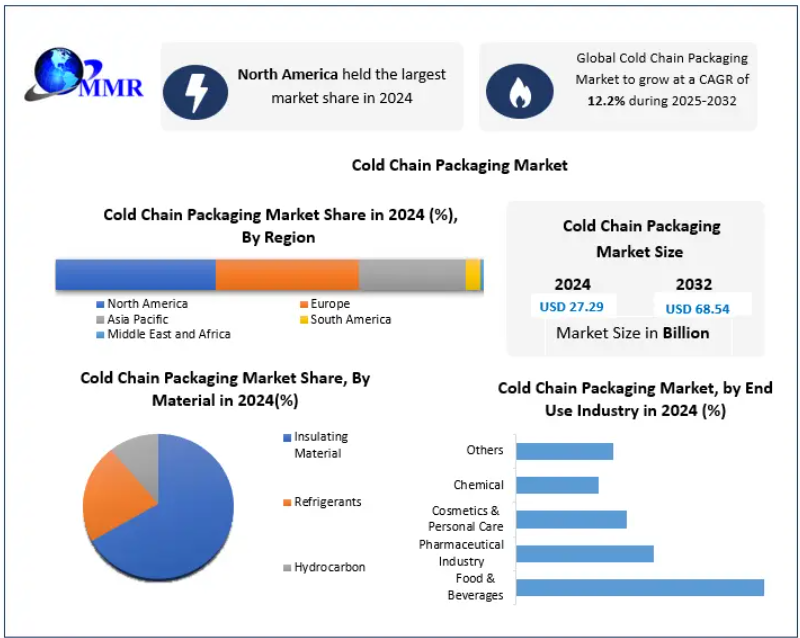

The Global Cold Chain Packaging Market was valued at USD 27.29 billion in 2024 and is projected to grow at a CAGR of 12.2% from 2025 to 2032, reaching approximately USD 68.54 billion by the end of the forecast period. The market’s rapid expansion is being driven by increasing demand from the pharmaceutical, biopharmaceutical, food & beverage, and clinical research industries, all of which rely heavily on temperature-sensitive logistics.

Cold chain packaging ensures product integrity and safety by maintaining controlled temperature conditions throughout storage and transportation. With the growing need to transport vaccines, biologics, perishable foods, and specialty chemicals, this market is evolving into a crucial pillar of global supply chains. The rise of biologic therapies, growth in global food exports, and the post-pandemic emphasis on healthcare resilience are strengthening the demand for high-performance, sustainable, and digitally connected packaging systems.

Gain insights into the most attractive segments — click here to receive a free sample of the report:https://www.maximizemarketresearch.com/request-sample/200335/

Key Market Dynamics

1. Surge in Demand for Perishable and Temperature-Sensitive Goods

The global appetite for perishable foods, pharmaceuticals, and biologics has fueled the demand for cold chain packaging solutions. As online grocery platforms and food delivery services expand, ensuring freshness and quality during long-distance transport has become a logistical priority. Cold packaging technologies offer optimal insulation, helping maintain product stability even in extreme transit conditions.

2. Expanding Pharmaceutical and Biopharma Industry

With the accelerating production of biologics, vaccines, and precision medicines, pharmaceutical companies are relying more on validated thermal packaging systems. Aging populations and the growing prevalence of chronic diseases are further increasing global healthcare product distribution, amplifying the need for reliable, temperature-controlled packaging.

3. Rising Sustainability Initiatives

Eco-friendly packaging is becoming a core competitive advantage. Manufacturers are adopting recyclable materials, reusable containers, and low-carbon refrigerants to align with environmental regulations and corporate sustainability goals. Companies like Sonoco ThermoSafe and Softbox Systems are leading efforts to introduce reusable thermal shippers and closed-loop logistics programs that minimize waste.

4. Cost and Operational Challenges

While essential, cold chain packaging involves significant investment in insulation materials, temperature-monitoring sensors, and specialized logistics systems. The requirement for refrigerated transportation and storage facilities adds to overall operational costs. Balancing product protection with affordability remains a key challenge for industry players.

Segment Analysis

By Type:

- Insulated Containers & Boxes dominated the market in 2024, capturing over 57% of global revenue. Their widespread use in food processing, pharmaceuticals, and produce transportation underscores their importance. These systems are available in a range of payload sizes—small to large—and are increasingly being designed for reusability.

- Cold Packs, Crates, and Temperature-Controlled Pallet Shippers also hold growing significance as industries seek modular and cost-effective solutions for short-term transport and last-mile delivery.

By Material:

- Insulating Materials such as expanded polystyrene (EPS), polyurethane, and vacuum-insulated panels (VIPs) form the backbone of thermal packaging.

- Refrigerants and Hydrocarbon-based materials play a crucial role in maintaining precise temperature ranges across varying transit durations.

By End-Use Industry:

- Pharmaceuticals and biologics remain the fastest-growing end-user segment, driven by vaccine distribution and biotech innovations.

- Food & Beverages continues to be a dominant application area, especially with the growth of cold-chain-enabled retail and cross-border exports of premium perishables.

- Cosmetics, chemicals, and personal care sectors are adopting cold chain packaging to protect temperature-sensitive formulations from degradation.

Regional Insights

North America held the largest share of the market in 2024, owing to its robust biopharmaceutical ecosystem, advanced logistics networks, and stringent regulatory standards. The region’s leadership is supported by consistent investment in R&D, clinical trial logistics, and sustainable packaging initiatives.

Europe follows closely, driven by strong pharmaceutical exports, food safety standards, and widespread adoption of reusable packaging systems. Countries such as Germany, the UK, and France are at the forefront of innovation in insulation and digital temperature tracking.

Asia-Pacific is emerging as the fastest-growing market, powered by rapid growth in pharmaceutical manufacturing hubs like India, China, and South Korea, expanding e-commerce networks, and increasing investment in cold storage infrastructure.

South America and the Middle East & Africa regions are experiencing rising adoption rates as governments and private players invest in healthcare modernization, food preservation, and vaccine distribution systems.

Gain insights into the most attractive segments — click here to receive a free sample of the report:https://www.maximizemarketresearch.com/request-sample/200335/

Competitive Landscape

The cold chain packaging market is moderately consolidated, with key players emphasizing technological innovation, sustainability, and global expansion.

Leading Companies Include:

- Cold Chain Technologies (USA)

- Peli BioThermal (USA)

- Sonoco ThermoSafe (USA)

- Softbox Systems (UK)

- Sofrigam (France)

- va-Q-tec AG (Germany)

- Intelsius (UK)

- Cryopak (Canada)

- DS Smith Packaging (UK)

- Orora Group (Australia)

These companies are enhancing their portfolios through smart packaging integrations, IoT-enabled tracking, and renewable energy-driven operations. Strategic mergers, partnerships with logistics providers, and the introduction of reusable thermal shippers are key strategies shaping market competition.

Key Trends Shaping the Market

- Reusable Packaging Revolution: Shift toward durable, multi-cycle packaging systems to cut costs and environmental impact.

- IoT and Smart Sensor Integration: Adoption of connected devices for real-time monitoring of temperature, humidity, and shipment conditions.

- Growth in Biopharma Logistics: Expansion of global biologic and vaccine supply chains requiring ultra-low-temperature packaging solutions.

- Sustainable Material Innovation: Development of biodegradable insulation materials and low-GWP refrigerants to meet eco-compliance standards.

Recent Developments

- May 2025: Peli BioThermal (U.S.) launched IoT-enabled thermal shippers featuring RFID/GPS sensors and real-time dashboards, alongside a transition to 100% renewable electricity across major facilities.

- March 2025: Sonoco ThermoSafe (U.S.) published an industry-wide sustainability report highlighting increased adoption of recyclable and reusable packaging solutions.

Conclusion

The Global Cold Chain Packaging Market is entering a transformative phase where sustainability, digitalization, and reliability converge to redefine global logistics. As industries move toward biologic therapies, temperature-controlled e-commerce, and cross-border food trade, cold chain packaging will remain a strategic enabler of quality assurance and compliance. Companies that invest in smart, sustainable, and reusable systems will lead the next wave of innovation in this rapidly expanding market.