Shipbuilding Market: Global Transformation Driven by Green Technologies, Digital Shipyards & Rising Maritime Trade (2025–2032)

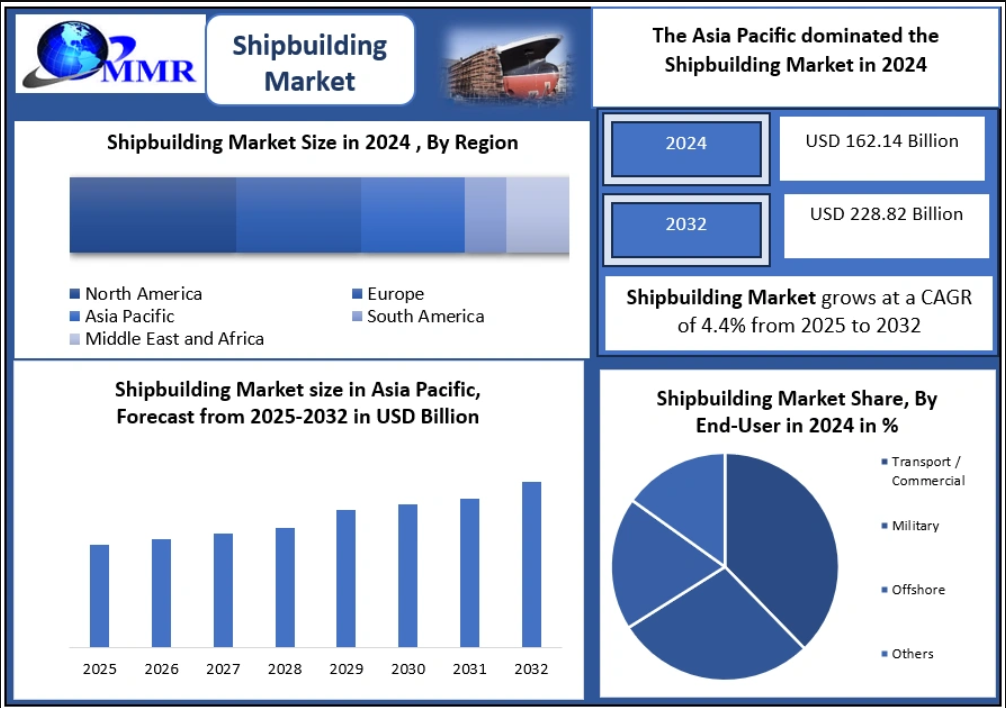

The global Shipbuilding Market, valued at USD 162.14 billion in 2024, is on track to reach USD 228.82 billion by 2032 at a CAGR of 4.4%, driven by accelerating seaborne trade, technological modernization, and a massive regional shift in shipyard capacity toward Asia. As over 90% of global trade moves by sea, shipbuilding remains the backbone of global commerce, energy security, and military modernization.

Today, China, South Korea, and Japan dominate 93% of global shipbuilding output, shaping the industry’s pace, pricing, and technological direction.

Market Overview: A Sector at the Center of Global Maritime Transformation

Shipbuilding involves the designing, engineering, construction, and launching of vessels used for commercial cargo, naval operations, offshore exploration, and passenger transport. Beyond global trade, shipbuilding is crucial for:

- Energy transportation (LNG, oil, LPG, hydrogen)

- Defense and national security

- Cruise tourism

- Offshore and renewable energy supply chains

The Asia Pacific region remains the undisputed industry leader, with:

- China – 53% global share

- South Korea – 28%

- Japan – 12%

These shipbuilding hubs are rapidly expanding smart shipyards, investing in AI-driven production, and embracing eco-friendly technologies in response to new IMO environmental rules and rising global demand for alternative-fuel vessels.

Click here to claim your free sample report and uncover the most lucrative market segments:https://www.maximizemarketresearch.com/request-sample/148775/

Key Market Trends

- Green Shipbuilding Becomes Mandatory, Not Optional

With IMO 2030/2050 targets tightening, shipbuilders are transitioning to:

- LNG-powered vessels

- Methanol- and ammonia-ready ships

- Hybrid propulsion systems

- Wind-assisted propulsion

- Carbon Capture Systems (CCS)

In 2024, over 45% of all alternative-fuel newbuild orders were for container ships, reflecting rapid decarbonization in the global logistics sector.

China, South Korea, and Japan lead investments in green ship technologies, while Europe remains active in sustainable cruise ship designs.

- Digital Shipbuilding & Industry 4.0 Revolutionize Production

Industry 4.0 is transforming shipyards through:

- Digital twins for lifecycle optimization

- AI-powered design & planning

- Robotic welding & automated block assembly

- 3D printing for complex components

- IoT-enabled smart yards

These advancements are reducing production timelines, cutting labor requirements, and improving vessel safety and operational efficiency.

The demand for autonomous ships and unmanned surface vessels (USVs) is rising, driven by defense, offshore, and commercial applications.

Market Drivers

- Expanding Seaborne Trade

Global supply chains increasingly depend on maritime transport. Rising trade in:

- E-commerce

- Energy (LNG, oil, hydrogen)

- Raw materials

- Containerized goods

is fueling demand for container ships, tankers, LNG carriers, and bulk carriers.

China alone produced more commercial tonnage in 2024 than the U.S. has built since WWII, demonstrating unmatched industrial scale.

- Massive Government Support

Countries are boosting shipbuilding through:

- Subsidies & tax incentives

- Shipyard modernization funds

- Green financing schemes

- Naval fleet expansion

Examples include:

- India targeting 5% of global shipbuilding share by 2032

- South Korea & Japan investing billions in LNG and hybrid vessels

- EU’s sustainability programs for next-gen cruise and passenger ships

Market Restraints

Shortage of Skilled Workforce & Rising Labor Costs

Aging workforces and declining interest in technical vocations are creating shortages in:

- Welders

- Marine engineers

- Digital-manufacturing specialists

- Naval architects

Labor costs have risen 15–25% over the last five years in Japan, South Korea, Europe, and North America.

China remains competitive due to abundant labor resources and government-backed maritime training programs.

Segment Analysis

By Ship Type

Container Ships dominate the market, accounting for 34–36% of all ship orders in 2024.

Growth drivers include:

- Explosion of e-commerce

- Need for mega-container ships (15,000–24,000 TEU)

- Transition toward dual-fuel and methanol-ready vessels

China commands 70% of global CGT orders for container ships.

By Material Type

Steel remains the undisputed leader, representing 85% of all shipbuilding material usage due to its:

- Strength

- Durability

- Cost-efficiency

- Suitability for large oceangoing vessels

Global marine steel demand exceeded 23 million tonnes in 2024, with China accounting for 45%.

Click here to claim your free sample report and uncover the most lucrative market segments:https://www.maximizemarketresearch.com/request-sample/148775/

Regional Insights

Asia Pacific: The Global Command Center of Shipbuilding

In 2024:

- China built 36 million GT, capturing 53% of the global share

- South Korea: 18 million GT, specializing in high-value LNG carriers

- Japan: 10 million GT, focusing on hybrid and energy-efficient vessels

Key Highlights

- APAC captured the majority of USD 204 billion in global shipbuilding orders in 2024

- China exported 75% of its ship output

- India targets rapid expansion with plans to secure 5% global share by 2030

APAC will remain the global shipbuilding hub throughout 2025–2032.

Top 5 Dominant Shipbuilding Countries (2025)

| Rank | Country | 2024 CGT Share | Key Strengths | Challenges |

| 1 | China | 70% | Massive workforce, full-spectrum production, state support | Overcapacity, U.S.–China trade tensions |

| 2 | South Korea | 17% | LNG carrier leadership, advanced engineering | Labor shortages |

| 3 | Japan | 13% | Efficient hybrid vessels, industry consolidation | Aging workforce |

| 4 | Philippines | Rapid growth | Low labor cost, strong repair sector | Infrastructure gaps |

| 5 | Vietnam | Rising regional player | Incentives, growing capacity | Technology gaps |

Competitive Landscape: Highly Consolidated & Asia-Driven

Top players include:

Asia

- HD Hyundai Heavy Industries

- Samsung Heavy Industries

- Hanwha Ocean

- CSSC

- CSIC

- Imabari Shipbuilding

- Mitsubishi Heavy Industries

- Cochin Shipyard

- Mazagon Dock Shipbuilders

Europe

- Fincantieri

- Damen Shipyards

- Lürssen

- Meyer Werft

Australia

- Austal Limited

These players are expanding global shipyard alliances, investing in smart-yard technologies, and competing for LNG carrier and dual-fuel ship orders.

Recent Industry Developments

Hyundai Heavy Industries: HCX-23 Stealth Trimaran

- 130 m stealth naval vessel

- Laser weapon systems

- Drone integration & advanced radar

- 48-cell VLS system

China: Mega Merger of CSSC & CSIC

- USD 56 billion combined assets

- USD 130 billion annual revenue

- 257 ships ordered in 2024

- World’s largest shipbuilding conglomerate

Conclusion

The global shipbuilding market is entering a transformative decade where:

- Green fuels

- Digitalized shipyards

- Mega-container ships

- Autonomous vessels

- Geopolitical realignments

will redefine competitiveness.

Asia Pacific will continue to dominate global production, but emerging players like India, Vietnam, and the Philippines are stepping up with new investments and government-backed strategies.

As global shipping expands and decarbonization accelerates, shipbuilding will remain one of the world’s most strategic and rapidly evolving industries through 2032.