Automotive Market in Mexico: Growth Outlook, Industry Dynamics, and Key Opportunities

The Automotive Market in Mexico is projected to reach USD 70.8 billion by 2026, expanding at a CAGR of 6.8% during the forecast period. As one of the world’s most strategically positioned automotive hubs, Mexico has evolved into a critical manufacturing base and export powerhouse for North America and global markets.

Industry Overview

Mexico has built a robust automotive ecosystem supported by 21 global OEMs, including Volkswagen/Audi, Mercedes-Benz, BMW, Ford, Toyota, and KIA. These companies manufacture vehicles across 14 states, highlighting the geographical diversity and strength of the industry.

Between 2000 and 2017, the sector attracted nearly USD 60 billion in FDI, representing 12% of Mexico’s total foreign investment. By 2018, the country produced 3.9 million vehicles, registering a 6% growth in exports, which positioned Mexico as the fourth-largest vehicle exporter globally.

Despite geopolitical uncertainties and global economic fluctuations, Mexico continues to rank as the 7th largest light vehicle manufacturer worldwide and the leading automotive producer in Latin America. By 2021, the country was expected to reach a production output of close to 5 million vehicles annually.

The automotive industry is also Mexico’s second-largest industrial contributor, generating over 800,000 direct jobs and accounting for around 2.9% of national GDP—significantly higher than Mexico’s average economic growth rate.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/86993/

Strengths of Mexico’s Automotive Sector

Mexico’s global competitiveness in vehicle manufacturing is anchored by several core advantages:

✔ Cost-Competitive Manufacturing

Lower labor and logistics costs make Mexico a preferred destination for OEMs and suppliers targeting North American markets.

✔ Strategic North American Location

Proximity to the United States—one of the world’s largest vehicle markets—offers unmatched supply chain and export benefits.

✔ Long-standing Industry Experience

Mexico’s first automotive plant was established in 1921, giving it a century of accumulated industrial knowledge.

✔ Skilled Technical Workforce

Engineering and technical universities provide a continuous pipeline of qualified labor.

✔ Advanced Infrastructure

Well-developed road networks, ports, and logistics facilities support efficient supply chain operations.

Regulatory Changes Under USMCA

The replacement of NAFTA with the United States–Mexico–Canada Agreement (USMCA) has reshaped automotive trade dynamics in North America. Key updates include:

- Higher regional value content requirement: Increased from 62.5% to 75% (effective 2023) to qualify for duty-free exports.

- Labor wage conditions: At least 40–45% of a vehicle must be produced by workers earning USD 16/hour.

- More predictable trade environment: Reduced risk of unexpected U.S. trade tariffs.

- Long-term treaty duration: A 16-year validity provides stability for long-term investment planning.

While the higher wage requirements present challenges, they also encourage greater automation, localization, and technology adoption, drawing Tier-1 and Tier-2 suppliers closer to OEM operations in Mexico.

Opportunities for International & Swiss Companies

Mexico’s shifting automotive landscape opens significant entry points for foreign businesses, particularly those known for innovation and precision engineering.

Key opportunities include:

- Component manufacturing aligned with USMCA’s local content rules

- Advanced robotics, automation, and Industry 4.0 technologies

- Electric vehicle (EV) systems and charging infrastructure

- R&D centers for lightweight materials, design, and prototyping

Swiss companies, in particular, benefit from their reputation for quality and technological sophistication. Establishing operations in Mexico’s northern and central automotive clusters enables proximity to OEMs and strengthens collaboration with established Mexican partners.

- Growth Projections and Industry Outlook

The Mexican automotive industry is expected to grow by 60% through 2021, driven by vehicle production, export expansion, and strong U.S. demand. As production surpasses 5 million light vehicles annually, new challenges and opportunities arise:

Challenges

- Sustaining a skilled workforce

- Enhancing domestic engineer training programs

- Strengthening logistics and transportation infrastructure

- Supporting long-term energy and port capacity growth

Opportunities

- Job creation and higher-value manufacturing roles

- Expansion of supplier networks across multiple states

- Increased foreign investment in EVs and sustainable mobility

The industry currently contributes 19% of Mexico’s manufacturing GDP and 25% of total exports. Shipments to the U.S. alone exceed USD 50 billion, underscoring Mexico’s essential role in North American vehicle supply chains.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/86993/

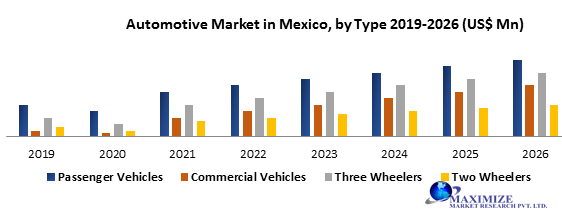

Market Segmentation

The automotive market in Mexico includes:

- Passenger Vehicles

Cars, SUVs, and light vehicles drive the majority of production and exports.

- Commercial Vehicles

Medium and heavy-duty trucks, vans, and fleet vehicles support industrial and trade sectors.

Segmentation is further categorized by application, vehicle type, and regional markets, reflecting variations in production cost, supply chain access, and state-specific industrial policies.

Key Players in the Mexican Automotive Market

Leading OEMs operating in Mexico include:

- Volkswagen

- Toyota

- Nissan

- Fiat

- MAN SE

- Mitsubishi

- Mercedes-Benz

- Renault

- Honda

- Hyundai

- KIA

- Volvo

- BMW

- Subaru

- BYD

- Chery

- Geely

- JAC Motors

- Lifan

- Peugeot

- Others

These companies collectively shape Mexico’s automotive output, drive export momentum, and create opportunities for local and international suppliers.

Conclusion

Mexico stands among the world’s most dynamic automotive production hubs, strengthened by competitive manufacturing advantages, a strategic location, and evolving trade regulations under USMCA. With rising production capacity, growing FDI, and expanding opportunities in EVs and automation, the Mexican Automotive Market is poised for sustained growth through 2026 and beyond.