Europe E-Bike Market (2025–2032): Growth Outlook, Emerging Trends, and Strategic Insights

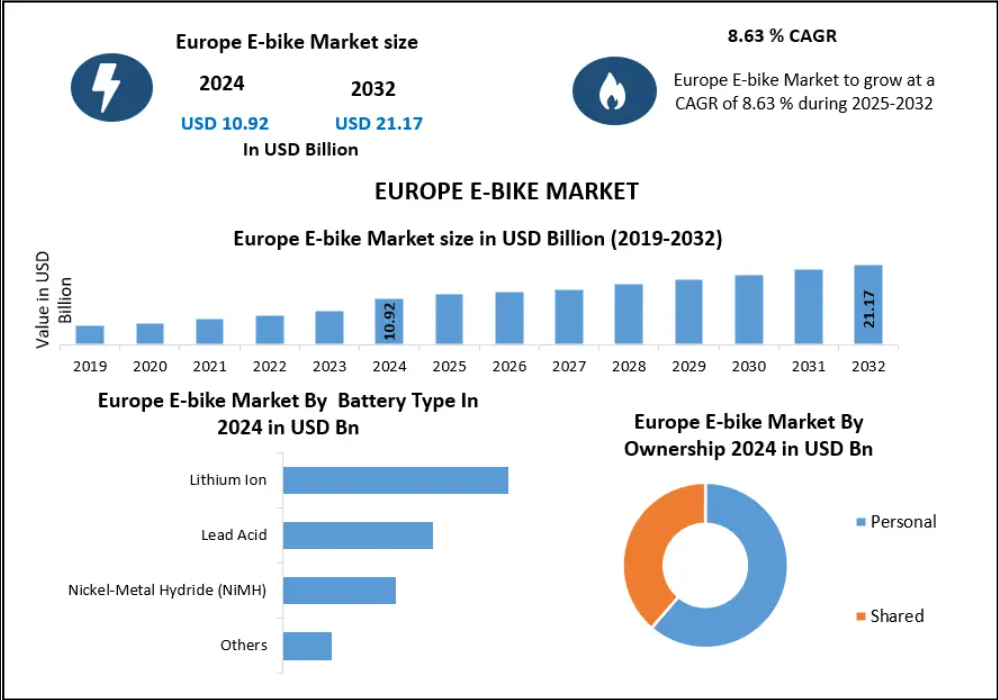

The Europe E-Bike Market, valued at USD 10.92 billion in 2024, is on a strong growth trajectory, projected to reach USD 21.17 billion by 2032, expanding at a CAGR of 8.63%. Europe’s rapid transition toward green mobility, combined with robust regulatory support, rising urban mobility challenges, and advanced e-bike technologies, is reshaping transportation modes across the continent.

E-bikes have evolved from niche recreational vehicles to mainstream mobility solutions, becoming an integral part of urban commuting, leisure cycling, and logistics. The sector’s transformation is driven by sustainability goals, consumer behavior shifts, and innovations in batteries, motors, and lightweight materials.

Market Overview: Sustainability and Smart Mobility Drive Adoption

Europe’s intensified focus on environmental protection, CO₂ reduction, and energy efficiency has positioned e-bikes as a preferred alternative to cars and conventional bicycles. From city commuters to long-distance trekkers, e-bikes are gaining traction due to:

- Lower environmental impact

- Reduced commuting time

- Improved infrastructure (dedicated cycling paths, charging points)

- Government subsidies and tax benefits

- Growing health and fitness consciousness

A strong wave of digital integration, smart displays, IoT-enabled GPS tracking, and app-controlled riding features further enhances user experience and supports market expansion.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/21420/

Key Market Drivers

- Surge in R&D and Technological Innovation

E-bike manufacturers across Europe are investing heavily in R&D, focusing on:

- High-efficiency motors

- Lightweight integrated batteries

- Enhanced range and speed

- Smart connectivity and safety features

Urban cargo e-bikes—supported by subsidies—are emerging as prominent car replacements for families and last-mile logistics providers.

- Rising Imports and Expanding Domestic Production

In 2023, e-bike imports to the EU surged by 14.8%, reaching over 1.18 million units. Countries like Portugal, Germany, and the Netherlands have strengthened their manufacturing ecosystems, boosting exports and creating competitive advantages.

- Government Incentives Accelerating Adoption

Europe’s strong policy framework includes:

- Purchase subsidies (Germany, France, Austria)

- VAT reductions

- Leasing programs

- Investments in cycling lanes and charging infrastructure

These initiatives are critical in converting conventional bicycle users into e-bike owners.

Market Challenges

High Initial Investment

Despite falling battery prices over time, e-bikes remain significantly more expensive than traditional bikes—often priced above €2,000—which limits adoption among price-sensitive consumers.

Battery & Component Supply Constraints

Battery shortages and capacity limitations from suppliers like Bosch E-Bike Systems have impacted production timelines. Supply chain disruptions remain a notable bottleneck.

Regulatory Fragmentation Across Countries

Inconsistent regulations regarding:

- Maximum speed

- Motor capacity

- Licensing norms

- Safety requirements

add complexity for manufacturers and hinder cross-border sales.

Range Anxiety and Maintenance Concerns

Consumers still fear insufficient battery range for long rides, and complex e-bike electronics require higher maintenance compared to traditional bicycles.

Segment Analysis

By Mode

Pedal Assist E-Bikes dominate 2024 sales due to:

- Energy efficiency

- Extended battery life

- Compliance with EU regulations (typically 250W, 25 km/h limit)

Throttle E-Bikes, although smaller in share, are gaining traction for short urban trips and riders seeking effortless mobility.

By Design

- Non-Foldable E-Bikes lead due to stronger frames, better battery capacity, and suitability for daily commuting and cargo applications.

- Foldable E-Bikes are rapidly growing in urban areas where portability and compact storage are essential.

By Battery Type

- Li-ion batteries dominate due to high energy density, lighter weight, and longer lifespan.

- Lead-acid and NiMH play a marginal role.

By Usage

Key demand categories include:

- City/Urban E-Bikes – largest segment

- Mountain/Trekking – driven by adventure tourism

- Cargo E-Bikes – booming in last-mile delivery

- Racing and Specialty E-Bikes – niche but expanding with sports adoption

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/21420/

Regional Insights

Germany: Europe’s E-Bike Powerhouse

- Sold 2.2 million e-bikes in 2023

- Holds 48% share of bicycle sales

- Strong manufacturing ecosystem and highest revenue contribution

Despite economic pressures, Germany’s e-bike market remains resilient, supported primarily through leasing models and rising urban demand.

Netherlands: The Highest E-Bike Penetration

- 30% household ownership, the highest in Europe

- 50% of all bicycles sold are e-bikes

- Strong culture of cycling and supportive regulations

Belgium, Austria, and Switzerland (DACH)

- Ownership: Germany (17%), Austria (18%), Switzerland (21%)

- These regions outpace most European nations in adoption but still trail the Netherlands.

UK, France, Italy, Spain

These countries are witnessing accelerated e-bike adoption driven by urban congestion and lifestyle changes, but infrastructure development remains a work in progress.

Competitive Landscape

Europe’s market is highly fragmented with strong presence of domestic and international brands.

Key Manufacturers

- Accell Group

- Brompton Bicycle

- CUBE Bikes

- Kalkhoff Werke

- Pon Holdings

- Riese & Müller

- Royal Dutch Gazelle

- VanMoof

- Haibike

- Gocycle

- Moustache Bikes

- Swiss E-Mobility Group

- Bianchi

- AIMA

- TENWAYS

- Lekker Bikes

- WATT E-Bike

- BearEBike

- E-BIKE FANTOM

- Others

Competition centers around innovation, battery range, pricing strategies, distribution channels, and sustainability compliance.

Future Outlook: E-Bikes to Surpass 10 Million Annual Sales by 2025

Europe is on track to witness 10 million e-bike sales per year by 2025, outpacing electric cars and solidifying its role as a global leader in eco-friendly mobility. Rising fuel prices, congestion concerns, digital integration, and health-oriented lifestyles will continue driving demand.

Cargo e-bikes, shared mobility fleets, high-speed Class III e-bikes, and smart urban commuting platforms are expected to reshape the next generation of mobility ecosystems.

Conclusion

The Europe E-Bike Market is entering a transformative phase where sustainability, innovation, and urban mobility needs converge. Despite challenges around cost and component supply, the sector’s long-term outlook remains highly optimistic. With robust regulatory support, increasing consumer adoption, and strong manufacturer participation, Europe is poised to lead the global e-bike revolution through 2032 and beyond.