German Electric Vehicle Market: Rapid Electrification Poised to Quadruple EV Adoption by 2027

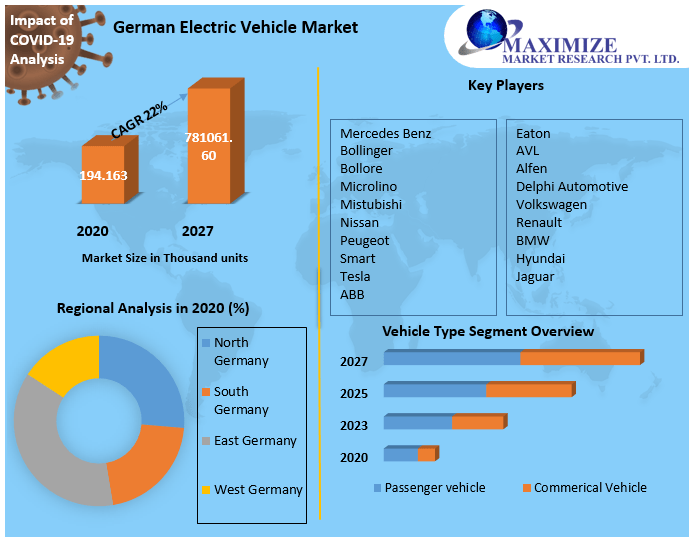

The German Electric Vehicle Market, valued at 194,163 thousand units in 2020, is set for an accelerated growth phase. According to industry projections, the market is expected to expand at a remarkable 22% CAGR from 2021 to 2027, ultimately reaching 781,061.60 thousand units by 2027. Driven by ambitious government policies, large-scale investments in charging infrastructure, and Germany’s powerful automotive manufacturing capabilities, the country is rapidly emerging as one of the world’s most dynamic EV markets.

Germany’s Strong Foundation for Electric Mobility

Germany is globally recognized as the third-largest automobile manufacturer after China and Japan. This powerful automotive ecosystem, combined with its leadership in renewable energy, makes Germany a fertile ground for EV expansion.

The country has been dubbed “the world’s first renewable energy economy,” as renewable sources surpassed coal in 2019 to contribute over 40% of Germany’s energy mix. With plans to phase out all 84 coal-based power units by 2038, the move to clean mobility aligns perfectly with the national energy agenda.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/64254/

Government Commitment and Massive Investments

The German government has pledged €1.68 billion to expand electric mobility. Other major national initiatives include:

- 28,000 high-emission vehicles scheduled for upgrades.

- A strategic plan to reach 1 million public charging stations by 2027.

- A committed investment of more than USD 3.37 billion for charging infrastructure.

- An additional $1 billion stimulus fund, introduced in response to Covid-19, dedicated to EV expansion.

These measures have created a robust environment that encourages adoption and strengthens industry confidence.

German Electric Vehicle Market Dynamics

- Expanding Charging Infrastructure to Meet Surging Demand

Germany’s EV transformation hinges on its ability to develop an extensive, reliable charging network.

- By 2027, the country will require 180,000 to 200,000 public chargers to support 5.7–7.4 million EVs.

- By 2030, this demand will rise to 448,000–565,000 chargers.

- However, chargers installed in 2018 will only meet 12–13% of charging demand in 2025, and 4–5% in 2030 — highlighting the urgent need for expansion.

Despite these challenges, Germany’s EV-to-charger ratio is improving. The average number of EVs per standard charger is forecast to increase from 9 in 2020 to 14 in 2027, reflecting greater charging efficiency and faster charging technologies.

- Wealthy and Urban Regions Lead EV Uptake

Affluent areas and metropolitan regions currently show the highest charging demand gaps due to higher EV adoption rates. However, as second-hand EVs become accessible, demand is rapidly spreading to less affluent and rural areas.

Urban regions also face unique challenges as many households lack access to home charging, further increasing the reliance on public chargers.

- Strong Collaboration Between Government and Automakers

Germany’s EV ambitions are supported by partnerships between the government and major automotive manufacturers. In 2019, German authorities and top automakers agreed to:

- Boost mass EV production.

- Increase consumer incentives, raising subsidies for vehicles priced below €40,000 from €4,000 to €6,000 per unit.

This collaboration has created a powerful environment where manufacturers like Volkswagen, BMW, Mercedes-Benz, Audi, and Porsche can accelerate their electrification strategies.

German Electric Vehicle Market Segment Analysis

- By Drive Type

Segments: BEV, PHEV, Hybrid

Germany has experienced explosive growth in plug-in vehicle penetration:

- In December 2020, plug-ins represented 26.6% of new car sales — a monumental jump from 4% in 2019.

- Full Battery Electric Vehicles (BEVs) reached a 14% market share, with Plug-in Hybrid Electric Vehicles (PHEVs) close behind at 12.6%.

- Volkswagen dominated Germany’s BEV market with 24% share, followed by Renault at 16%.

The rapid uptake signals Germany’s transition from a combustion-focused market to one that prioritizes fully electric mobility.

- By Vehicle Type

Segments: Passenger Vehicle, Commercial Vehicle

Passenger EVs account for the majority of sales due to:

- Attractive subsidies

- Wider model availability

- Urban sustainability policies

- Growing consumer awareness

Commercial EVs, although still emerging, are gaining demand in logistics, delivery fleets, and corporate mobility as companies commit to carbon neutrality.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/64254/

Key Market Trends Shaping the Future of EV Mobility in Germany

- Growing Secondary EV Market

More EVs are now reaching the used-car market, expanding accessibility.

- Rising Public Charging Usage

Reduced home-charging availability in cities is increasing dependence on fast-charging and public charging networks.

- Strong OEM Pipeline

German manufacturers are aggressively expanding their electric vehicle line-ups, supported by billions in R&D investments.

- Rapid Urban Electrification

Cities such as Berlin, Munich, and Hamburg are leading in EV uptake and charging infrastructure expansion.

German Electric Vehicle Market Scope

- Base Year: 2020

- Forecast Period: 2021–2027

- CAGR: 22%

- Market Size 2027: 781,061.60 thousand units

- Segments: Drive Type (PHEV, BEV, Hybrid), Vehicle Type (Passenger, Commercial)

Leading Companies in the German Electric Vehicle Market

Major players contributing to Germany’s EV leadership include:

- Mercedes Benz

- Volkswagen

- BMW

- Tesla

- Renault

- Hyundai

- Jaguar

- Nissan

- Peugeot

- Smart

- Mitsubishi

- Bollinger

- Microlino

- ABB

- Eaton

- AVL

- Alfen

- Delphi Automotive

These firms are advancing battery innovation, expanding EV portfolios, and investing heavily in charging technologies.

Conclusion: Germany on Course to Lead Europe’s EV Revolution

Germany’s rapid electrification push, driven by strong policy support, massive infrastructure investment, and leadership from global automotive giants, is transforming the country into one of the most advanced electric mobility ecosystems worldwide.

With EV sales projected to quadruple by 2027, and a national strategy aligned with decarbonization and energy transition goals, Germany is positioned to become Europe’s largest and most influential electric vehicle market.