Mexico Aluminium Market Outlook

According to the report by Expert Market Research (EMR), the Mexico aluminium market was valued at USD 3.74 billion in 2024. Aided by the growing demand from the construction, automotive, packaging, and electronics sectors, the market is projected to grow at a CAGR of 5.40% between 2025 and 2034 to reach a value of USD 6.33 billion by 2034. The increasing adoption of lightweight materials to improve fuel efficiency, enhance structural integrity, and promote sustainability is one of the key factors driving the market expansion.

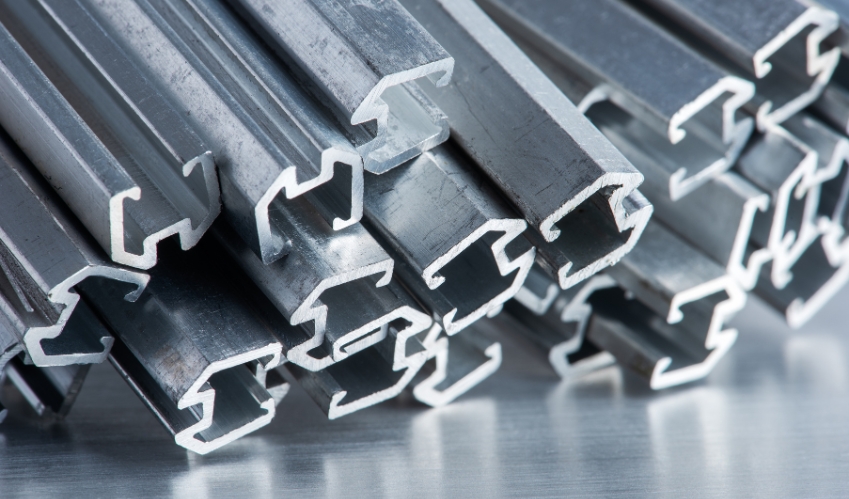

Aluminium, a lightweight and corrosion-resistant metal, plays an essential role across several industrial and consumer applications. It is widely used in building and construction, transportation, electrical systems, and packaging due to its strength-to-weight ratio, durability, and recyclability. Mexico, with its rapidly growing manufacturing base and strategic trade relationships, particularly with the United States under the USMCA (United States-Mexico-Canada Agreement), is witnessing strong demand for aluminium and its downstream products.

The aluminium industry in Mexico benefits from an expanding automotive manufacturing sector, robust infrastructure development, and increasing investments in renewable energy projects. As industries shift towards sustainability, the ability of aluminium to be endlessly recycled without losing quality positions it as a preferred material in eco-friendly manufacturing practices.

Mexico Aluminium Market Size and Share

The Mexico aluminium market, valued at USD 3.74 billion in 2024, represents one of the most dynamic metal markets in Latin America. With strong demand from key end-use industries, Mexico is emerging as a leading regional hub for aluminium production and consumption. The market is anticipated to reach USD 6.33 billion by 2034, driven by both domestic demand and export opportunities.

In terms of market segmentation, the aluminium extrusion and rolled products segments account for a significant share due to their extensive use in the construction and automotive industries. The automotive sector, which forms a vital part of Mexico’s industrial economy, represents a major consumer of aluminium as the country continues to attract investments from global automakers seeking cost-effective manufacturing bases. Additionally, aluminium foundry products hold a growing share, supported by their application in engine components, wheels, and other vehicle parts.

Geographically, industrial hubs such as Nuevo León, Coahuila, and Baja California lead aluminium demand due to the concentration of automotive, aerospace, and electronics manufacturers. Moreover, the country’s export-oriented manufacturing model, supported by its proximity to the U.S. market, ensures sustained growth in aluminium trade volumes.

Download a free sample report, complete with the Table of Contents – https://www.expertmarketresearch.com/reports/mexico-aluminium-market/requestsample

Mexico Aluminium Market Trends

Several key trends are shaping the growth trajectory of the Mexico aluminium market:

- Rising Automotive Lightweighting Initiatives:

With the global shift towards electric vehicles (EVs) and fuel-efficient mobility, aluminium’s light weight and strength make it an essential material in automotive production. Mexican manufacturers are increasingly incorporating aluminium components to meet global emissions and performance standards. - Sustainability and Circular Economy Practices:

Aluminium recycling is gaining traction in Mexico, supported by both governmental policies and private sector initiatives. Recycled aluminium requires only about 5% of the energy used in primary production, making it economically and environmentally beneficial. - Growth in Renewable Energy Infrastructure:

Aluminium’s use in solar panels, wind turbines, and power transmission lines is rising with Mexico’s ongoing renewable energy transition. The expansion of solar and wind projects has significantly boosted aluminium demand for structural and electrical applications. - Technological Modernisation in Smelting and Fabrication:

Advanced technologies such as AI-driven quality monitoring, automation, and precision extrusion are being integrated into aluminium processing facilities. These innovations enhance production efficiency, reduce waste, and improve product quality. - Rising Demand for Aluminium Packaging:

The packaging industry in Mexico, driven by the increasing consumption of beverages, food products, and pharmaceuticals, is witnessing higher adoption of aluminium due to its non-toxic, lightweight, and recyclable nature.

Drivers of Growth

The growth of the Mexico aluminium market is underpinned by multiple factors:

- Expanding Automotive Industry: Mexico’s position as one of the top vehicle manufacturers globally drives aluminium demand for car bodies, wheels, and engine components. The growing penetration of EVs further amplifies this demand.

- Infrastructure Development: Rapid urbanisation and major public infrastructure projects, including transportation networks and residential construction, are fuelling demand for aluminium extrusions, windows, and cladding materials.

- Trade Integration and Export Growth: Mexico’s strategic geographic position and trade agreements enable strong export potential for aluminium and related products to North America and global markets.

- Recycling and Sustainability Initiatives: The increasing emphasis on circular economy principles supports the development of recycling plants and secondary aluminium production facilities.

- Technological Advancements in Manufacturing: Enhanced smelting technologies and process automation are reducing production costs while improving energy efficiency.

Technology and Advancement

Technological innovation is transforming the aluminium industry in Mexico. The integration of digital technologies, automation, and advanced production systems is enabling manufacturers to enhance quality and operational efficiency.

Modern casting and extrusion technologies allow producers to manufacture high-precision components that meet stringent industry standards, especially in automotive and aerospace applications. Companies are investing in advanced furnaces, robotic handling systems, and AI-driven monitoring solutions to ensure consistent quality and minimise material waste.

Additionally, sustainability-focused technologies, such as low-carbon aluminium production and scrap recycling systems, are gaining prominence. Secondary aluminium smelting facilities are increasingly utilising renewable energy sources, aligning with global decarbonisation efforts. The use of advanced simulation and data analytics is also improving process control, helping manufacturers achieve better cost optimisation and environmental performance.

Mexico Aluminium Market Segmentation

The market can be divided based on type, processing method end use and region.

Market Breakup by Type

- Primary

- Secondary

Market Breakup by Processing Method

- Flat Rolled Products

- Castings

- Extrusions

- Forgings

- Pigments and Powder

- Rod and Bars

Market Breakup by End Use

- Automotive

- Aerospace and Defence

- Building and Construction

- Electrical and Electronics

- Packaging

- Industrial

- Others

Market Breakup by Region

- Baja California

- Northern Mexico

- The Bajío

- Central Mexico

- Pacific Coast

- Yucatan Peninsula

Competitive Landscape

Some of the major players explored in the report by Expert Market Research are as follows:

- Aluminio Industrial Mexicano, S.A. de C.V.

- Arzyz, SA de CV

- ALRETECH

- Norsk Hydro ASA

- Fracsa Alloys

- Grupo Valsa

- Riisa

- Others

Challenges and Opportunities

Despite promising growth prospects, the Mexico aluminium market faces several challenges:

- High Energy Consumption: Aluminium production is energy-intensive, and fluctuating electricity prices can impact manufacturing costs.

- Import Dependence: Limited domestic production capacity makes the market reliant on aluminium imports, exposing it to global price volatility.

- Environmental Regulations: Stricter emissions and waste management standards increase compliance costs for producers.

However, the market presents significant opportunities:

- Recycling and Secondary Aluminium Production: Investments in recycling facilities can reduce import dependence and promote circular economy practices.

- Growth in Electric Vehicles: The rapid adoption of EVs offers lucrative opportunities for lightweight aluminium components.

- Renewable Energy Projects: Aluminium’s use in solar and wind energy infrastructure is expected to expand substantially in the coming decade.

- Technological Upgradation: Adoption of Industry 4.0 technologies and low-carbon production methods will enhance global competitiveness and sustainability.

Mexico Aluminium Market Forecast (2025–2034)

The Mexico aluminium market is expected to experience robust growth over the forecast period, expanding at a CAGR of 5.40% from 2025 to 2034. The market value is projected to rise from USD 3.74 billion in 2024 to USD 6.33 billion by 2034. The growth trajectory will be driven by continuous industrial expansion, technological innovation, and sustainability-oriented policies.

The automotive and construction industries will remain primary growth drivers, supported by Mexico’s position as a key manufacturing hub in North America. Increased investments in renewable energy and infrastructure will further boost demand. The packaging and electrical sectors are also expected to witness steady growth due to evolving consumer lifestyles and electrification trends.

As Mexico enhances its aluminium recycling and processing capacities, the country is likely to emerge as a competitive supplier in the global aluminium market. With ongoing efforts to improve energy efficiency and adopt greener production technologies, the Mexico aluminium industry is well-positioned to achieve sustainable, long-term growth through 2034.

Media Contact:

Company Name: Claight Corporation

Email: sales@expertmarketresearch.com

Toll Free Number: +1–415–325–5166 | +44–702–402–5790

Address: C-130 Sector 2 Noida, Uttar Pradesh 201301

Website: https://www.expertmarketresearch.com