Managing employee payroll is one of the most critical tasks for any business owner, and accurate reporting is essential for compliance with the Internal Revenue Service (IRS). One of the most important payroll documents is the W-2 form, which reports an employee’s annual wages and tax withholdings. QuickBooks simplifies the process of creating, managing, and filing W-2 forms, helping businesses save time while maintaining accuracy.

This comprehensive guide explains how to handle W-2 forms in QuickBooks, including creating, reviewing, printing, and filing them. We also provide tips on troubleshooting common issues and highlight the support resources available for QuickBooks users.

Easily create, print, and file W-2 forms in QuickBooks. Expert help available at +1-866-500-0076.

Understanding W-2 Forms

The W-2 form, officially titled Wage and Tax Statement, is a document employers must provide to employees and the IRS each year. It details:

- Total wages earned by an employee

- Federal, state, and local tax withholdings

- Social Security and Medicare contributions

Employees use the W-2 form to file their annual tax returns, and the IRS relies on it to verify income and tax payments. Failure to provide accurate W-2 forms can result in penalties for businesses.

Why Use QuickBooks for W-2 Forms

QuickBooks is a leading accounting and payroll software widely used by small and medium-sized businesses. It offers several advantages for managing W-2 forms:

- Automated Calculations: QuickBooks automatically calculates wages, deductions, and taxes, reducing errors.

- Time-Saving: Users can generate W-2 forms for all employees in just a few clicks.

- Electronic Filing: QuickBooks allows direct e-filing with the IRS and Social Security Administration (SSA).

- Compliance Support: Ensures that W-2 forms adhere to the latest IRS regulations.

By leveraging QuickBooks for W-2 forms, employers can reduce manual errors and ensure timely submission.

Creating W-2 Forms in QuickBooks

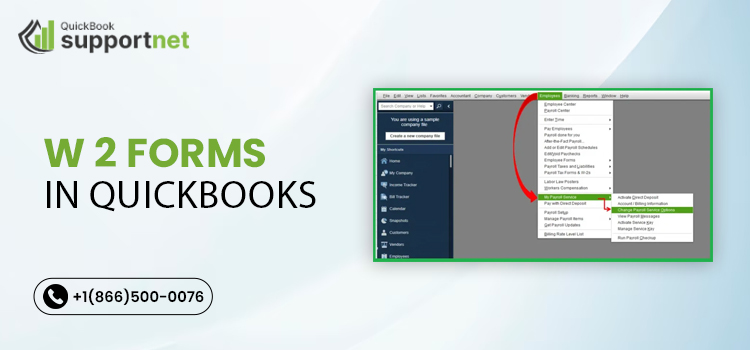

Here is a step-by-step guide to creating W-2 forms in QuickBooks:

- Update Payroll Data

Before generating W-2 forms, ensure that all payroll data for the year is complete and accurate. This includes employee names, Social Security numbers, and wages. - Access Payroll Center

Open QuickBooks and go to the Payroll menu. Select Payroll Center and navigate to the File Forms tab. - Select W-2 Form

Choose Annual Form W-2/W-3 – Wage and Tax Statement. QuickBooks will prompt you to select the year for which the forms need to be generated. - Verify Employee Information

Review each employee’s details carefully. Ensure that Social Security numbers, addresses, and wage amounts are correct. Mistakes can delay processing and result in penalties. - Generate W-2 Forms

Once verification is complete, QuickBooks automatically generates W-2 forms. You can preview them to check for accuracy. - Print or E-File

QuickBooks provides options to either print W-2 forms for employees or electronically file them with the SSA. If printing, make sure to use official forms compatible with the IRS format.

Read This Blog: QuickBooks Error PS038

Printing W-2 Forms in QuickBooks

Printing W-2 forms requires careful attention to ensure they meet IRS standards. Follow these steps:

- Select Employees

In the W-2 form preview, select all employees for whom you need to print forms. - Choose Printer Settings

QuickBooks recommends using a laser printer for clear, legible printing. Avoid inkjet printers as they may cause smudging. - Print Copies

Print three copies for each employee:- Copy A: For the SSA

- Copy B: For federal tax filing

- Copy C: For employee records

- Distribute Forms

Provide employees with their W-2 forms by the IRS deadline (January 31). Retain copies for your records for at least four years.

Filing W-2 Forms with the IRS

QuickBooks simplifies filing by providing electronic filing options. E-filing has several benefits:

- Faster Processing: Electronic forms reach the IRS quickly.

- Error Reduction: QuickBooks validates data before submission.

- Confirmation: Receive confirmation from the IRS upon successful filing.

To e-file W-2 forms in QuickBooks, follow the on-screen instructions in the Payroll Center. Ensure that your QuickBooks subscription includes e-filing services.

Common Issues and Troubleshooting

Even with QuickBooks, users may encounter issues while managing W-2 forms. Common problems include:

- Incorrect Social Security Numbers

Always double-check employee information before generating forms. Incorrect SSNs can lead to IRS penalties. - Incomplete Payroll Data

Missing wage or tax information can prevent W-2 generation. Ensure all payroll entries are complete. - Printing Errors

If forms do not print correctly, check printer settings, paper type, and QuickBooks form templates. - E-Filing Rejections

Electronic submissions can be rejected due to mismatched employee data. Correct the errors and resubmit promptly.

For assistance with troubleshooting, call +1-866-500-0076 for expert QuickBooks support.

Tips for Smooth W-2 Management

To make W-2 processing seamless in QuickBooks, consider these tips:

- Update Employee Records Regularly: Ensure addresses, tax filing status, and Social Security numbers are accurate.

- Maintain Payroll Accuracy: Reconcile payroll accounts regularly to prevent discrepancies.

- Backup QuickBooks Data: Create backups before generating W-2 forms to prevent data loss.

- Schedule Deadlines: Set internal deadlines to review and distribute W-2 forms before the IRS deadline.

For additional help, QuickBooks experts can provide step-by-step guidance at +1-866-500-0076.

Conclusion

Accurate W-2 forms are essential for both employees and the IRS. QuickBooks simplifies the creation, printing, and filing of these forms, ensuring compliance and minimizing errors. By following best practices, maintaining up-to-date employee records, and leveraging QuickBooks’ features, employers can streamline their payroll reporting process. For professional guidance on W-2 forms in QuickBooks or any payroll-related queries, you can call +1-866-500-0076.

Read More: How to File Form 941 in QuickBooks Like a Pro: Complete 2025 Guide