Managing accounts payable (AP) is one of the most critical yet time-consuming aspects of any business. For growing companies, handling AP efficiently is crucial to maintaining healthy cash flow, improving supplier relationships, and ensuring compliance. In recent years, accounts payable business process outsourcing (AP BPO) has emerged as a strategic solution for companies seeking cost savings, operational efficiency, and improved accuracy. This comprehensive guide explores everything businesses need to know about outsourcing their AP processes.

What Is Accounts Payable Business Process Outsourcing?

Accounts payable business process outsourcing refers to delegating the management of your company’s payables to a third-party provider, often a specialized BPO firm. Instead of handling invoice processing, vendor payments, and reconciliations in-house, businesses outsource these tasks to experts who manage the workflow efficiently and accurately.

AP BPO can cover a wide range of services, including:

- Invoice receipt and processing

- Vendor management

- Payment execution

- Expense and purchase order matching

- Compliance and audit support

- Reporting and analytics

By leveraging AP BPO, companies can focus on core operations while improving financial efficiency.

Why Businesses Choose Accounts Payable Business Process Outsourcing

1. Cost Savings

One of the most significant benefits of accounts payable business process outsourcing is cost reduction. Maintaining an in-house AP team involves salaries, benefits, software, and infrastructure costs. Outsourcing allows businesses to convert fixed costs into variable costs, paying only for the services they need. Many companies report savings of 30–60% when moving AP functions to a BPO provider.

2. Improved Accuracy and Compliance

Errors in invoice processing or payment can lead to late fees, strained vendor relationships, and compliance issues. AP BPO providers use standardized workflows, automation tools, and multi-level quality checks to minimize errors. They also ensure compliance with tax regulations, audit requirements, and internal company policies.

3. Faster Turnaround Time

Processing invoices and payments manually can be slow, especially during peak periods. Outsourced AP teams, often operating in different time zones, can provide round-the-clock operations. This results in faster invoice approvals, timely payments, and better supplier satisfaction.

4. Access to Advanced Technology

Leading AP BPO providers use state-of-the-art software and automation tools such as:

- OCR (Optical Character Recognition) for invoice scanning

- Cloud-based AP platforms

- AI-powered workflow automation

- ERP integration with SAP, Oracle, QuickBooks, or NetSuite

By outsourcing, businesses can access these technologies without investing heavily in infrastructure or training.

5. Scalability

As your business grows, your AP workload increases. Scaling an in-house team can be costly and time-consuming. With accounts payable business process outsourcing, BPO providers can quickly adjust staffing and resources based on transaction volume, seasonal fluctuations, or business expansion.

Key Processes Covered in AP BPO

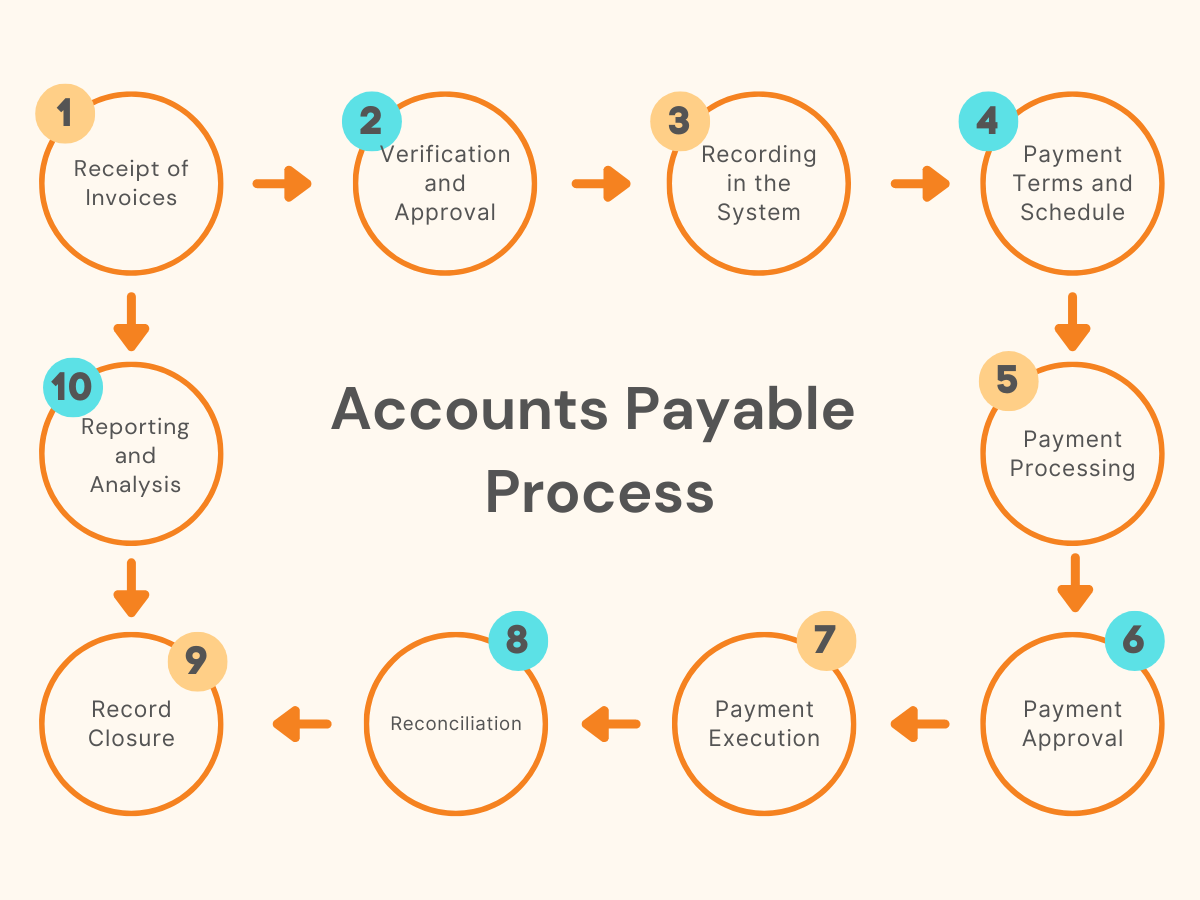

A full-service AP BPO provider handles the end-to-end accounts payable lifecycle. Typical processes include:

- Invoice Receipt & Validation – Capturing and validating invoices against purchase orders.

- Data Entry & Coding – Recording invoice details accurately in accounting systems.

- Approval Workflow Management – Routing invoices to the appropriate managers for approval.

- Payment Processing – Executing payments via checks, ACH, or wire transfers.

- Vendor Communication & Management – Handling queries, disputes, and reconciliations.

- Reporting & Analytics – Generating dashboards and insights for cash flow management.

- Audit & Compliance Support – Maintaining documentation for regulatory and internal audits.

By outsourcing these tasks, companies can ensure accuracy, efficiency, and timely payments.

Benefits of Accounts Payable Business Process Outsourcing

- Reduced Operational Costs – Lower salaries, infrastructure, and software expenses.

- Enhanced Productivity – In-house teams can focus on strategic financial tasks rather than manual data entry.

- Minimized Errors – Standardized processes reduce invoice and payment mistakes.

- Improved Cash Flow Management – Faster processing allows better tracking of payables and working capital.

- 24/7 Operations – Global outsourcing enables round-the-clock processing.

- Better Supplier Relationships – Timely payments and accurate reporting improve vendor satisfaction.

Challenges to Consider

While accounts payable business process outsourcing offers many benefits, businesses should be aware of potential challenges:

- Data Security Risks – Sensitive financial information is shared with a third party. Choose a provider with strong cybersecurity measures and compliance certifications.

- Loss of Direct Control – Outsourcing requires trust and strong communication to maintain oversight.

- Process Misalignment – Ensure the BPO provider aligns with your company’s workflows, approval policies, and accounting standards.

- Cultural & Time Zone Differences – These can impact communication if not managed effectively.

How to Choose the Right AP BPO Provider

When selecting an accounts payable business process outsourcing partner, consider the following:

- Experience & Expertise – Look for providers with proven experience in your industry.

- Technology Stack – Ensure they use modern AP software and automation tools.

- Compliance & Security – Check certifications like ISO 27001, SOC 2, and data protection policies.

- Scalability – The provider should handle fluctuations in workload smoothly.

- Transparent Pricing – Understand pricing models (per invoice, monthly package, or FTE-based).

- Client References – Speak with current or past clients to gauge reliability and service quality.

Conclusion

Accounts payable business process outsourcing is no longer just a cost-cutting measure; it is a strategic approach to improve financial efficiency, accuracy, and scalability. By outsourcing AP functions, businesses can access specialized expertise, advanced technology, and streamlined workflows while freeing in-house teams to focus on strategic finance and growth initiatives.

For companies looking to reduce costs, enhance cash flow, and improve supplier relationships, AP BPO is a powerful solution that can transform the way finance operations are managed.