The financial service sector in Ireland stands at the brink of transformation. With the expansion of technological capabilities and shifts in customer expectations, it redefines the very definition of the “bank”—the fundamental mindset shift from selling financial products to becoming a trusted person in people’s lives.

The primary aim of the finance industry is to enhance connectivity. For example, the Bank of England has upgraded its Real Time Gross Settlement (RTGS) service. It is central to innovation in wholesale payments. Moreover, Ireland’s fast payment system is a foundation of real-time payment.

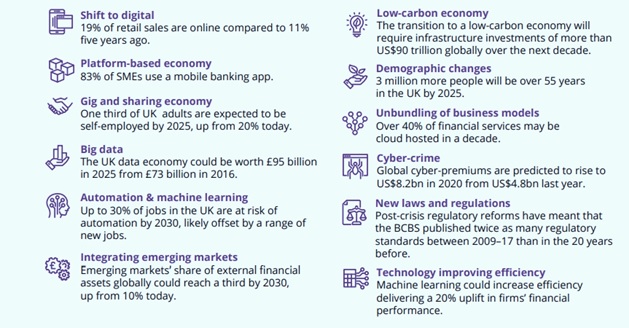

What Major Transitions is the country heading towards?

According to the Bank of England’s updates, “the country’s economy prioritises the importance of lowering the costs in the finance sector. However, it is going to be a tough deal.” Moreover, Britain’s role as the financial trading hub may evolve as emerging markets grow. It is also about considering political decisions with the EU.

All these changes may drive significant changes in the Irish economy. At the same time, they raise challenges fundamental to the traditional models of regulations and the economic landscape. Below is the basic overview of the upcoming shifts in Ireland (financial, demographic, and digital changes) according to the Bank of England’s findings.

What do all these changes mean for the financial industry?

This shift in the new advanced economy may benefit the loan borrowers. It may enable them to borrow, save, and invest without worries.

For example, if they are searching for poor credit loans in Ireland online, they may get one quickly without detailed documentation. Getting it becomes easier with improved affordability tracker systems and assessments. It helps one meet the requirements without falling on the finances.

Moreover, they can transfer the risks and make repayments without sabotaging the financial identities. Instead, it helps and fuels the economy by maximising savings and allocating more capital to growth. Eventually, it fosters creativity, innovation, and contributes to rising prosperity. Here are other aspects of how these changes may re-fuel the financial economy:

- It may help the banks, lending institutions, and societies adopt a more personalised approach. It would be more accessible and secure than the current structure.

- Finance and regulation will have to adapt to an ageing society. It should help the new entrants in the economy, especially those in the gig economy.

- Innovation should focus on building financial literacy. It grants more control over the finances and supports more active digital identification, considering the inclusion.

- An improved financial structure may help the businesses benefit from the international opportunities. Eventually, it may help reduce cross-border transactions. Instead, it may provide businesses with access to new markets.

What are the major challenges the country faces?

Challenges like complying with the new financial regulations and implementing them across the country are a struggle. It requires good capital and cooperation on both ends. Moreover, the current gaps in the data privacy and cross-border payments make it further more difficult. Here are other potential challenges that the country faces in ensuring the best financial set-up:

- Ensuring the implementation without cultural or technological bias

- Upgrading the core systems requires a whopping amount of capital and coordination. It may include improving the settlement systems, payment rails, and identity systems.)

- Exposure to outages grows as reliance on digital systems grows. It means that cyber attacks may affect the whole infrastructure.

- Inequal access to digital tools and services. It is about financial development, inclusion, and not leaving any group behind.

- Transition in finances risks the sustainable structure. It is all about pricing the risks rightly and deciding accordingly.

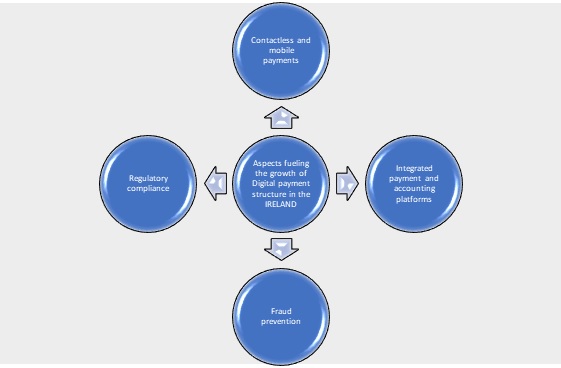

How does vast API adoption improve the Digital payment interface?

The widespread adoption of API’s, batch processing, and open banking solutions has significantly improved the growth of the digital payment system. According to IBIS world, the market may reach £9.7 billion by 2025, compounded at an annual growth rate of 6.6%. However, what is fueling the expansion? Let’s know.

Integrated payment solutions that connect and support automated reconciliation, real-time analysis, and seamless user experience are critical tools for business scalability.

It may especially help startups and SMEs to handle payments quickly. It is because open banking may help businesses receive customers’ payments in no time. It eliminates the need for monitoring and managing the credit card infrastructure or fees. It thus helps you create data rich in accuracy and automation. It reduces the reliance on a manual workforce. Instead, it helps promote the potential for innovation and creativity.

How should traditional direct lenders adapt to the new financial changes?

It is about adapting to the new customer requirements and desires rather than about the technology. Everyone wants fast and secure access to funds without compromising security. Thus, instead of taking this new technical advancement as a threat to their existing set-up, they must upgrade to a better tomorrow. Here is how:

-

Invest in the right digital infrastructure

Switch to cloud-based platforms rather than the traditional data saving structure. It helps improve operational efficiency and helps you save large data sets without worrying about space. Moreover, it helps you ensure more consistent services.

-

Improve the customer journey

Identify what your customers and target audience desire at the point in time. Invest in advanced tools and set up to research and note the behaviour changes. Identify where your regular customers struggle. It could be a process, transaction, application form filing, navigation, etc. You can also address this using heatmaps on your site.

-

Integrate AI and automation setup

You can invest in the AI and automation aspect to leave it mostly to the machines. It helps you cut on redundancy and invest more time into growing your business, testing new strategies. You can automate tasks like payroll, marketing, audits, accounting, and other aspects. Moreover, doing so helps you save on hiring and workforce management costs.

-

Improve the cybersecurity structure

According to the UK government’s Cyber Security Breaches Survey in 2024, “ more than three-quarters of businesses, i.e., 75% of businesses, consider cybersecurity as the primary priority for senior management. Moreover, large businesses lead this trend and have increased their priority for this. 83% of businesses now have updated malware structures. Here are some tips to enhance security standards in Ireland:

- Implement multi-layered security

- Identify critical assets and vulnerabilities

- Install and maintain security software

- Manage access controls well

- Encourage timely reporting and upskill employees

-

Offer more personalised services/ products

Who does not like to get the same thing as they expect from a brand? Everyone does. So, why not simplify and provide personalised assistance to your customers as well? Investing in real-time stats analysis helps you identify the problems, needs, and expectations. Accordingly, a loan provider can modify and optimise the service set-up.

Bottom line

Thus, aspects like redefined payment channels, digitalisation, and adopting modern tools may improve the financial industry’s pace. It showcases a promising future for the country and may derive sound results. It aims at easing and quickening the direct lending structure to help customers save time and money.

However, every business must invest in research and experimentation before implementing the new and improved interface. It helps one understand the risks and benefits.